Products

Home > Our Products > RTI (Real Time Information) e-FilingRTI (Real Time Information) e-Filing

eFileReady provides user friendly, comprehensive and cost effective RTI eReturns to HMRC. The system will cover all RTI eReturns and eReceipts you need, regardless of any channel you use for your data interchange with HMRC. You can use our system for LIVE testing against HMRC's RTI Live server at any time.

Our system is not only the first to gain HMRC recognition, it has also been successfully used by members. More details about our system are as follows.

1. System Compatibility

SAP, Oracle, bespoke and other software package users have been successfully using our system for their various eReturns to the HMRC. The system is platform independent, cloud-based, and will be compatible with any system and any version of HR and Payroll you use.

The file formats the system supports for RTI eReturns to HMRC are:

CSV XML

2. The Range of RTI eReturns / eReceipts Supported

We support the full range of RTI Data eReturns and eReceipts, plus other additional services.

Complete range of RTI eReturns included are

• FPS: Full Payment Submission

• EPS: Employer Payment Summary

• NVR: NINo Verification Request

• FSY: Final Submission for the Tax Year

• Addn. FPS: Additional Full Payment Submission

• P11D

• P46 Car

• P6, P9, SL1, SL2, PGL1, PGL2 and NINO & RTI notices.

• CSV and XML channels are supported.

RTI Additional Services

• Produces Leaver P45 Data / PDFs for printing out

• Produces Year End P60 Data / PDFs on Completion of Final FPS

• e-Payslips.

• Supports daily, weekly, monthly, annual and anytime etc, pay run data

• Compatibility with your system is assured as it is 100% browser-based

• Many users have used the system successfully. It is very stable and reliable.

3a. How does e-Filing of Returns Work?

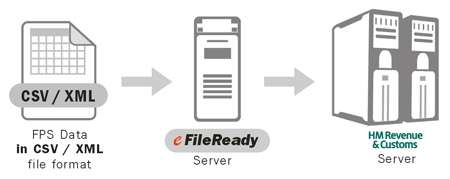

You may e-File your FPS, EPS, EYU and NVR returns with the www.eFileReady.com specialist eReturn system using a CSV file or a XML file. However, different file formats require different preparation. This section explains what may be involved when using different file formats for your returns.

3.1 - CSV File Format Approach

The steps involved to e-File your RTI returns using a CSV file are as follows:

Step 1: Request the template for the respective return you wish to make from eFileReady.com.

Step 2: Based on the template's specified data requirements you need to derive the data from the payroll system you use and place the data onto the template. The specifications for the data are given in the instructions document along with the template.

Step 3: Check the template containing all your data is in accordance with the instructions we specified. Our specifications are based on HMRC's Schema specification.

Step 4: Convert the Template into a CSV file.

Step 5: Upload the CSV file to www.eFileReady.com Server

Step 6: Make a final check on the uploaded RTI data and approve the data, or remove the data if your data contains errors and then repeat the uploading process when you are happy with the data.

Step 7: Click on the e-File button. Wait a few minutes and then you will be able to download the e-Filed Success Certificate, which contains the HMRC Timestamp and HMRC IR MARK.

3.2 - XML file Approach

The steps involved in e-Filing your RTI eReturns through XML file are similar to the CSV file approach. A XML file will come from a payroll package with the capability of producing the XML output inbuilt. The XML file in question must be fully in compliance with HMRC's various RTI required data specifications.

Step 1: After completing the pay run you can produce the XML file in your system

Step 2: Sign in to the www.eFileReady.com server and upload your XML file

Step 3: Make a final check on the uploaded RTI data and approve it, or remove the data if your data contains errors and then repeat the uploading process when you are happy with the data.

Step 4: Click on the e-File button. Wait a few minutes and then you will be able to download the e-Filed Success Certificate, which contains the HMRC Timestamp and HMRC IR MARK.

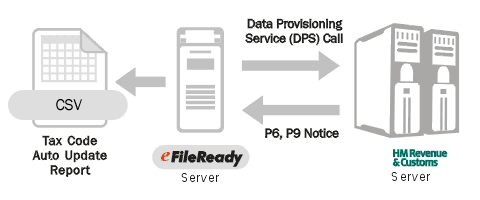

3b. How Does RTI eReceipts Work?

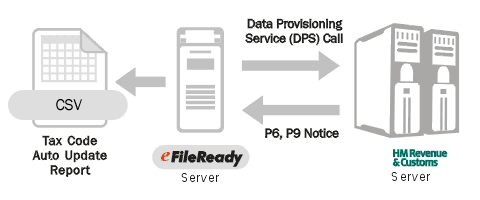

www.efileready.com will automatically unload all these notices for you into the eFileReady server for you to view. We will also convert the above mentioned files into CSV formats.

You can download the P6, P9, SL1, SL2, PGL1, PGL2 and NINO & RTI notices in a CSV format and then upload them to your payroll system for auto-tax code updates. However, to achieve auto-tax code or NINO updates you need to ask your software engineer to help you to map the data directly into your database

Under RTI, HMRC will send you various notices through its Data Provisioning Service (DPS). These notices include P6, P9, SL1, SL2, PGL1, PGL2, NINO & RTI

4. RTI eReturns - What and When to e-File

What and when you need to e-File is illustrated sequentially below. The data required for different returns will be provided in various templates which can be Request from www.eFileReady.com.

The RTI forms you need to e-File to HMRC are as follows

The instructions defining all the data specifications for each template can also be downloaded. All defined data specifications are based on HMRC's Quality Standards and HMRC RTI Schema.

4.1. Full Payment Submission (FPS)

All employers regardless of the number of employees you have.

The FPS tells HMRC who is in your company payroll and what payments you have made to the employees concerned.

Unique Service

Our system can help to consolidate your data from different locations and/or from different pay frequencies and e-File your FPS data in accordance with the HMRC requirements.

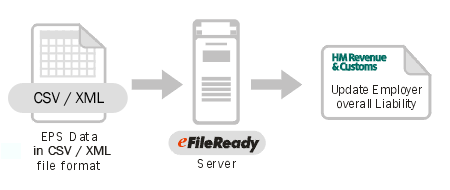

4.2. Employer Payment Summary (EPS)

EPS is a monthly return which allows the employer to recover statutory payments (SSP and SMP etc), CIS Deductions suffered or NIC Holidays, from HMRC. If you do not have any SSP, SMP, CIS suffered or NIC holiday to reclaim from HMRC you DO NOT NEED to e-File the EPS. Small companies may use the EPS to notify HMRC of dormant periods. For a typical Pension Provider, there may be exemption from e-Filing the EPS. The process you need to make for this return is the same as before i.e. request and download the template from efileready.com, fill it in and upload it back to the eFileReady server for e-Filing.

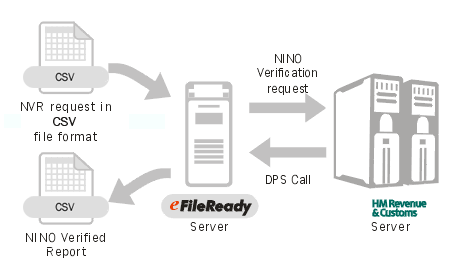

4.3. NINO Verification Request (NVR)

This submission allows employers to validate their employee's NINO (National Insurance number) or to obtain a NINO from HMRC for the Employee Details supplied on the NVR. The process is similar to the above process i.e. download the template from www.eFileReady.com, fill it in and then upload it back to eFileReady to e-file the NVR request to HMRC for NINO information. After e-filing you need to later log back in to www.eFileReady.com to view and/or download the responses from HMRC. The process is conducted through the HMRC's Data Provisioning Service (DPS). You will receive details of the specific NINO responses via NINO and RTI DPS notifications. You are then provided with an option to download the NINO and RTI DPS notifications in a CSV file enabling you to further upload to your system to update your employee's NINOs.

5. RTI eReceipts - What and When to Have

The system will automatically download all HMRC notifications, such as P6, P9, SL1, SL2, PGL1, PGL2 and NINO & RTI to your account so that you can then use the notifications to conduct auto-tax code updates.

Complete range of RTI Data eReceipts (DPS) included are

- P6, P9, SL1, SL2, PGL1, PGL2 and NINO & RTI notices Notices

- CSV and XML channels are supported

Auto Tax Code Updates

Once you sign up to our service we can help you do the auto tax code updates of your P6 or P9. This system is proven and has been used successfully by many very large employers since 2006. Our System will automatically fetch your tax codes, then convert them to a CSV format for you to upload to your server to conduct the auto tax code updates. This is done under the HMRC DPS system. The system supports the data of up to 250,000 employees.

Security

www.efileready.com takes security issues seriously and we are UKAS ISO 9001 & ISO/IEC 27001 certified. We have been providing specialist e-Filing services to leading UK companies, many of which are household names, for the last 6 years.

6. Pricing

It is a "Pay As You Use" system. You only need to pay for what you use. This can help to avoid the common pitfall of wasting money in acquiring a piece of unsuitable software that you never use.

It is a pay per use system. We will invoice you monthly based on the actual amount you use

Please click here for detailed prices

7. Guarantee of Success

Since the inception of eReturns eight years ago we have served many household name companies in the UK for various eReturn services to the HMRC and Companies House. None of our clients have encountered a failure in e-Filing their Returns or receiving their data e.g. P6 and P9 etc, from HMRC's DPS. We are the very first RTI eReturn system to have gained HMRC RTI recognition and the system also has been used by many members successfully. We can give a guarantee that your RTI eReturns and eReceipts will be just as successfull.