Products

Home > Our Products > MTD - Interest Restriction Return (IRR) eReturns to HMRCMTD - Interest Restriction Return (IRR) eReturns to HMRC

The Interest Restriction Return (IRR) is a return to be filed as an effect of the Corporate Interest Restriction (CIR) legislation. The return consists mainly of the summary details of the group and the calculation of any restriction or reactivation of interest. The return must be submitted by a nominated reporting company on behalf of the group within 12 months of the end of the return period.

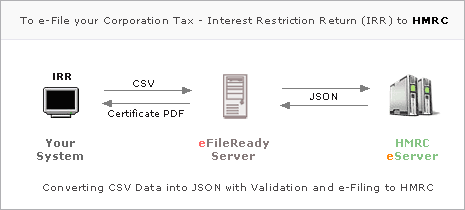

HMRC has now introduced a new submission mechanism for the Interest Restriction Return, under the MTD platform. Companies or Agents will now be able to use MTD IRR-enabled software to submit returns directly to HMRC.

Using eFileReady you can now submit your company’s or group’s either full or abbreviated Corporation Tax - MTD Interest Restriction Returns (IRR) to HMRC.

The following four submissions are provided: