Products

Home > Our Products > Making Tax Digital (MTD) VATBest MTD VAT BRIDGING SOLUTION

You can now e-File your VAT under Making Tax Digital (MTD) using a simple Excel spreadsheet with our MTD VAT BRIDGING SOLUTION. This will save you from the unnecessary costly upgrade of your current ERP/Accounting/VAT system.

What is a Bridging Solution for MTD VAT:

In simple terms, it provides a bridge between your current ERP/ACCOUNTING/VAT system and HMRC's MTD VAT system. The bridging system will take on your current VAT data placed in a Microsoft Excel or Open Office Spread sheet and convert the VAT data into the HMRC MTD VAT required format. After the data is converted, the bridging system will e-File the VAT data to HMRC using the digital link API. By using our system it is assured that your VAT returns will meet the MTD VAT technical requirement, the MTD VAT Bridging system provides the computing intelligence to complete the task for you.

MTD VAT Bridging Solution:

Our MTD VAT Bridging system is recognised by HMRC and was the first one to have successfully e-Filed a MTD VAT return under the MTD VAT Pilot Scheme to HMRC. It is very simple to use and easy to implement. Many of our clients have used our system for testing and making live returns of their MTD VAT data.

No more worry or additional work required for Making Tax Digital VAT. eFileReady's intelligent server will allow you to send your eReturns to HMRC using a simple CSV or XML file in exactly the same way as before. Whether you are sending a VAT or other eReturn under MTD you can continue to send your return through our intelligent server correctly with ease.

For those new to our service, you can learn more on how simple and cost-effective our system is below. Through eFileReady's intelligent server we can guarantee that your eReturn under MTD will be 100% successful, saving you time and money.

What will be changing?

There are indeed big changes when HMRC introduces new technologies with MTD. The good news is we are able to confine the new changes within our server, saving all our users from spending time and money in modifying their own system. We can guarantee all our users that MTD will bring them absolutely no pain when making VAT or any other eReturns HMRC may introduce.

Under MTD eFileReady will communicate with HMRC using OAuth2, Rest-based API and JSON. Since we are data interchange specialists, as well as a leading cloud solution provider, these new technologies HMRC are rolling out are already known and implemented by us. There will no doubt be variations and deviations in these technologies but it will take us no time to iron out the differences. From our professional point of view, this change made by HMRC is the right move as HMRC must use the much more efficient latest technologies to cope with volume and improve its speed and performance.

The challenge here is how to simplify these complicated new technologies to allow a user like you to continue with your business with ease. We can say with confidence that we are pretty good in this type of situation; we have done this many times before and MTD is just the latest change we will be taking care of for you.

HMRC is also rightly tightening their security procedures for the New API platform. Previously you just needed your User ID and Password to submit data, but now you need a 2-step verification to receive and submit data through eFileReady. This additional security credential setting is a one-time setup process which can be handled very easily. What it means is during the authentication process HMRC will send a code to your mobile phone or email on the fly for you to further enter into the log on credentials to complete the log on process. These days we all carry a mobile phone/device and this extra requirement should worry no one.

Perhaps the first MTD VAT eReturns solution on Mobile. Easy anywhere access to e-Filed VAT values, VAT Payments, VAT Liability details etc. in eFileReady MTD VAT Mobile App from HMRC's MTD VAT website in a jiffy. You don't have to Log in to HMRC everytime.

You can now view your VAT eReturns, Liabilities and Payments instantly under Making Tax Digital (MTD) on your mobile phone anywhere, anytime. It works like your Mobile banking system.

Install the App >>

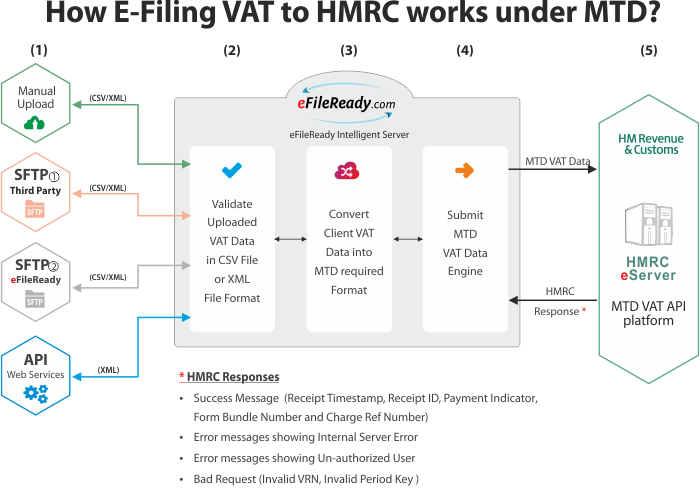

How e-Filing VAT to HMRC works under MTD?

www.eFileReady.com has developed an innovative unique cloud based intelligent auto data converter which will convert your VAT eReturn data file into HMRC's MTD VAT required format and further efile it to HMRC automatically. The steps below explain how to achieve MTD VAT eReturns without needing you to do any program changes.

Step 1:

Creating a MTD Account with HMRC

MTD VAT is a new service provided from a different HMRC system. To be able to send MTD VAT returns you need to log on to HMRC's website https://www.gov.uk/guidance/sign-up-for-making-tax-digital-for-vat to create a MTD account. Creating a MTD account is a matter of entering your company name and address, UTR, VAT Registration Number, Mobile device number (for receiving authentication codes) and other details at HMRC's website. Once your registration for MTD VAT is successful HMRC will sent you the MTD VAT Authorisation USER ID and PASSWORD by post to your given address.

Step 2:

Setting Up a MTD Authorisation for MTD VAT return

To start using MTD VAT services you need to create an account with our company at www.efileready.com. Please click on SIGN UP at www.efileready.com/signup.html to create an account now.

After you have signed up with eFileReady you need to sign in and click on eFile Ready Chart of Setup to enter the MTD VAT User details you have received by post from HMRC. Our system links up to HMRC for you to enter the HMRC MTD VAT user ID and password so that you can set up the MTD VAT Authorisations in conjunction with our MTD VAT eReturn system. When the MTD VAT Authorisation process is completed you will be able to conduct the MTD VAT eReturns using a normal CSV or XML file

Step 3:

Extract Data from your Accounting Software

The first step is to extract the VAT data from your accounting package or specialist VAT software calculator. Our system will accept the VAT data in either CSV or XML file formats. The XML file used should comply with HMRC's XML schema. You can extract the data for an individual client or for a batch of clients (i.e. VAT data of multiple clients in the same file). eFileReady will provide you with a template and a comprehensive instruction manual to guide you on the data requirements for extracting your MTD VAT data files.

Step 4:

Upload Data File into eFileReady

After signing in successfully, you can upload the VAT data file extracted from your accounting / VAT system software. Uploading a CSV or XML file into the eFileReady system is just as easy as sending an email with an attached file.

eFileReady supports batch uploading of multiple client's VAT data. You can upload the VAT returns of any number of clients using a single spreadsheet without any limitation. We have implemented this concept especially to support large companies and pay bureaus to save them time.

You may transmit your VAT data to us through SFTP or API arrangement.

Step 5:

Review the Data to be e-Filed

It is important to review the data you have uploaded before e-Filing it to HMRC. If any of your data fails to comply with the HMRC standards we will instantly advise you about what errors are in the file. You can further rectify and upload the data file once again. If required our support team will always be ready to assist you with the rectification.

Step 6:

E-File the Data to HMRC

You simply need to click on the 'E-file' button to submit the data to HMRC. The server will further conduct final checks on the uploaded data file and then e-File it for you.

If you are a first time user of our MTD service, it is mandatory to do the one time MTD VAT Setup in eFileReady. You will be allowed to e-File your MTD data only after completion of this MTD VAT Authorisation process.

Step 7:

Download Success Certificate and Reports

Under MTD, you will also need to store all your e-Filed data and reports digitally. www.efileready.com will issue a success certificate which includes HMRC's provided Timestamp and Receipt-Id . We provide various e-Filed data reports and search functions for you to view and print any MTD data you wish. In addition, our system will also store your data for up to 3 years.

Please contact us at enquiry@efileready.com to start using our MTD pilot services for VAT and Income Tax returns.